Digital solutions and e-documents give you, as a business owner, many advantages. They create the opportunity for efficient internal processes that increase your competitiveness and raise the level and digital ability of your business.

Below we go through VAT refund user stories – and describe how your business can take advantage of the opportunities in the future and create a more efficient and smoother everyday business life.

The digital process that uses the VAT refund specification in the transaction between the parties has not been put into production via the Peppol Network yet.

NSG&B has collected information from all Nordic countries and the EU and included this in the specification. Further work with the process will eventually enable system support and the exchange of transactions. This user story describes a future possible solution.

VAT refund user story

User story: Buyer and seller in the Nordic region if standard is in production:

Ensuring that your service provider is compliant with the standard format and standard network, and that the actors can create VAT refund application xml document and send it to the tax authorities, will give you better control, save time, and significantly reduce the risk of errors. It's also an environmentally friendly and more sustainable way to manage the reporting process. In the user story below, we go through the benefits that digital VAT refund process brings you as a business owner – with improved control and saved time at the core business process.

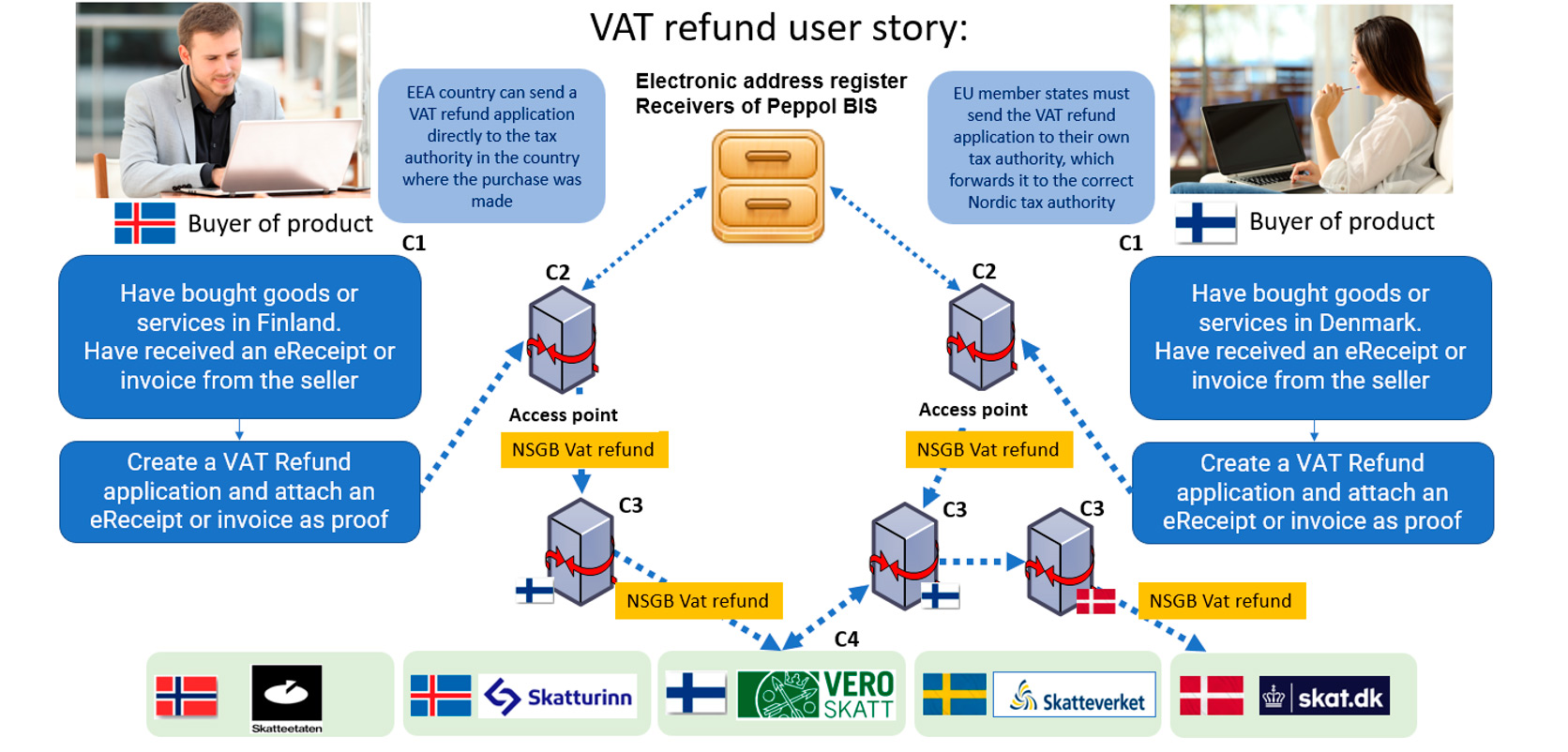

User story VAT refund between member states and EEA countries

An employee of an Icelandic company has been on a business trip to Finland. They take a taxi from the airport to their hotel. They use the company card for these payments.

The payment system in the taxi registers card information and payment. The backend system to the taxi (ERP) receives the information from the taxi and finds out the organization number that belongs to the company card number. The system collects all information and fills this into fields defined in the NSGB eReceipt format. ERP then sends the NSGB eReceipt to its access point, which forwards the transaction to the Icelandic employee's system. The system uses information from eReceipt to fill in an application for a VAT refund in Finland (An e-Invoice can also be used as evidence and input in a VAT refund application).

The application is based on NSGB VAT refund specification and create and machine-readable file (NSGB VAT refund xml).

The received eReceipt is then attached to NSGB VAT refund application as proof of the purchase made in Finland. The application with the attached eReceipt is then sent to the tax authorities in Finland via the Peppol Network. The tax authorities assess whether the application falls within the rules for VAT refund. A payment is then sent to the employee's company in Iceland.

User story VAT refund between member states.

An employee of a Danish company has been on a business trip to Finland. They take a taxi from the airport to their hotel. They use the company card for these payments.

The payment system in the taxi registers card information and payment. The backend system to the taxi (ERP) receives the information from the taxi and finds out the organization number that belongs to the company card number. The system collects all information and fills this into fields defined in the NSGB eReceipt format. ERP then sends the NSGB eReceipt to its access point, which forwards the transaction to the Danish employee's system. The system uses information from eReceipt to fill in an application for a VAT refund in Finland (An e-Invoice can also be used as evidence and input in a VAT refund application.)

The application is based on NSGB VAT refund specification and create and machine-readable file (NSGB VAT refund xml).

The received eReceipt is then attached to NSGB VAT refund application as proof of the purchase made in Finland. The application with the attached eReceipt is then sent to the tax authorities in Finland via the Peppol Network. The tax authorities assess whether the application falls within the rules for VAT refund. A payment is then sent to the employee's company in Denmark.

Benefits applicant for refund of VAT

Today, the process takes place completely or partly manually. By using systems and machine-readable information cross border, the process can be partly or totally automated:

- When the eReceipt is stored as a machine-readable file it is easier and faster for the employee to find it and link it to the various expense items than it would be to scan, save and upload the receipt in the system based on standard classification; an aggregated analysis for the company´s purchase is performed.

- Increased trackability and quality of information.

- Ability for the company to use the system to fill in information from eReceipt into the application of VAT, save time and increase quality.

- Opportunities to have control of VAT refund applications through the system.

- Options to receive machine-readable receipt messages cross-border and national in the same format and via standard transaction method.

- Easy to document VAT refund towards tax authorities.

- Improves quality of structured and validated data and help SMEs to streamline their internal processes.

- Possibility to shortens the handling time for tax authorities so the refund of money will be faster.

Benefits for tax authorities

Today, the process takes place completely or partly manually. By using systems and machine-readable information cross border, the process can be partly or totally automated.

- Can process machine-readable files via a system that results in efficient internal processes and increases the quality of information.

- By attaching a machine-readable eReceipt as proof, quality and efficiency can be increased.

- By including classification codes linked to the purchase, it is possible to determine more quickly whether the expenditure is refundable.

- Possibility of easier and faster analyses of VAT refunds.

Nordic SME – what to do to get digital

Becoming digital means improve all your processes and the result are more competitive in your national, Nordic, and European market using a single solution, rather than adhering to a manual and inefficient way of communicating with your customers and suppliers.

NSG&B has.

The NSGB VAT Refund specification must be further developed so that it becomes an VAT refund standard that can be used via a standard transaction network.

We would encourage service providers to develop services that support the process, the specification, and the way of exchanging messages both for VAT refund applicants and tax authority as recipients of VAT refunds. This will create efficiency in the processes for the individual employee, for the SMEs that has to document and send an application for refund of VAT and Nordic tax authorities.

Project manager Jan Andre Mærøe

Do you have questions about eReceipt or need to get in touch with the project manager?