Digital solutions and e-documents give you, as a business owner, many advantages. They create the opportunity for efficient internal processes that increase your competitiveness and raise the level and digital ability of your business.

Below we go through some ViDA report user stories – and describe how your business can take advantage of the opportunities in the future and create a more efficient and smoother everyday business life.

This process has been piloted by NSG&B and is therefore not yet available today. There will be further work on the format and processes in the near future.

VIDA report user stories

User story: Buyer and seller in the Nordic region

Ensuring that your service provider is compliant with the standard format and standard network, and that the actors can create ViDA report documents and send these to the tax authorities, will give you better control, save time, and significantly reduce the risk of errors. It's also an environmentally friendly and more sustainable way to manage the reporting process. In the user case below, we go through the benefits that ViDA report brings you as a business owner – with improved control and saved time at the core.

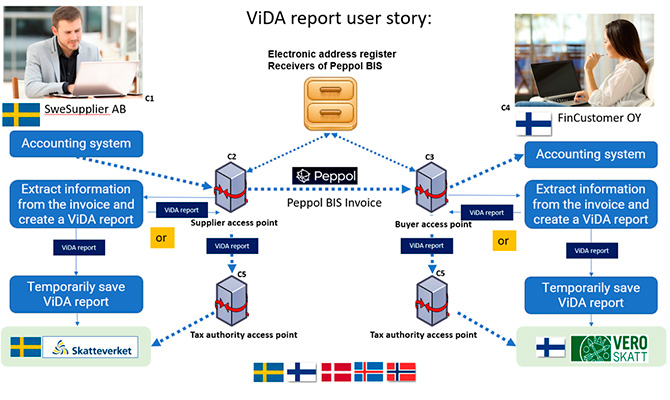

The Swedish company SweSupplier AB will invoice the Finish company FinCustomer OY with a Peppol BIS 3 invoice.

SweSupplier AB has a system that creates an invoice based on the order from FinCustomer OY. The system is compliant to Peppol BIS invoice, a mapping system informing of an access point whereby the service provider will create the standard invoice and ensure that it will be sent to FinCustomer OY in Finland through the Peppol Network.

The ViDA proposal requires that every business within the EU must share a subset of data from the invoice to the respective national tax authority.

At the same time as the invoice is sent to FinCustomer OY, the access point system of SweSupplier AB extracts defined information from the invoice, creates a ViDA report document, and sends it to the Swedish Tax Agency, which stores the report in its area for further processing. SweSupplier AB receive a confirmation from the tax authority.

FinCustomer OY receives an invoice from SweSupplier AB and sends it into its accounting system for approval and payment.

The FinCustomer OY access point also extracts defined information from the invoice and creates a ViDA report document and sends this to the Finnish tax authority, which stores the information for further processing. FinCustomer OY receive a confirmation from the tax authority.

User story: Tax-authorities in the Nordic region

The Tax Administration (TA) receives a ViDA report from the company/entity access point. When the report has been received and a technical validation has been successful, the sender receives confirmation of the successful sending of the report.

After the technical validation, the Tax Administration performs several substantial analyses on the reports. The first round may include ensuring that all essential information has been reported, and that the reported information is correct.

An example of a correct value for exempted sale (0% rated invoice; legal base: article 226(1)(11)(11a)), is VAT Tax Category Code K and VATEX Reason Code VATEX-EU-IC for intra-community supply within the European Union. As the VAT Tax Category Code is a structured option to indicate intra-community supply, we may also accept textual explanations, such as "intra-community supply reverse charge" or similar.

The VAT Tax Category Code is the structured and agreed code based on the EN16931 norm to indicate how this invoice should be treated in VAT accounting. The VATEX Reason Code is a structured way to explain the reason for 0% rated VAT. This is maintained and published by CEF and is applied within the European Union. The semantic model for invoicing also allows the use of textual explanation for 0% VAT transactions.

Intra-community supply is a transaction between two taxable entities within the European Union, where services or goods are sold from one member states to another. member state.

After checks, the national TA sends selected ViDA reports (potential domestic ViDA reports and reports on intra-community supply are separated) to the VIES Center according to the proposed regulation.

When the Tax Administration receives structured and validated data directly from the operators, the processing of such documents is more precise and accurate. This will improve handling of VAT data, and taxpayers benefit from more effective processing of their VAT data. It is expected that risk selection for control purposes will be more precise and focused on problem areas.

Benefits

Indirect tax fraud and evasion is a significant problem for most governments around the world. All governments are examining approaches to bring these gaps under control.

Reporting VAT relevant information based on transactions, such as the EU ViDA proposal, is one way to handle this challenge.

General benefits for multiple stakeholders:

Improves quality of structured and validated data in invoice

- Helps SMEs to improve their tax accounting.

- Shortens the handling time for more taxpayers.

- Reduces numbers of reporting burdens for SMEs

- Provides cost reductions.

- Using standard core data mode in the Nordic countries makes it more efficient to extract and analyse data.

According to the European Commission, the Once Only Principle.

Benefits for SMEs as buyers and sellers

Using the ViDA report for automatic transfer of VAT information to Tax Administrations in different countries will save time for both sellers and buyers.

- The ViDA report may significantly contribute to less work for the accounting department in most Nordic SMEs. The periodic mandatory statement on VAT used to allocate several hours of work when put together by the accounting department.

- Reduces number of differences in VAT reporting; these differences may cause work before and after reporting. The ViDA reporting system will contribute to and help create precise and correct reporting right from the beginning.

- The quality of data is improved in invoices sent by the SMEs and their daily cashflow is more accurate.

- Based on validated invoices and structured data, the Tax Administration can give more precise guidance to SMEs and their accountants. Accurate and structured data enables the development of virtual assistants or chatbots to give answers to FAQs.

- In the future, Statistical Authorities may use the same method to seamlessly obtain their data from the network.

Benefits for Tax Administrations

Tax Administrations will use the ViDA report to check that the VAT paid by sellers and buyers accords with what is traded and invoiced. The checks and analyses may include several approaches:

- Matching the seller's ViDA reports to the buyer’s ViDA reports to estimate that these are identical.

- Cluster ViDA reports based on the tax risks. The main target is to define as many taxpayers as possible into the group "compliant/low/medium risk", with the objective to cause them the least administrative burden as possible. A particular focus group is fraud and how to define fraud clusters as precisely as possible.

- ViDA reports may be used to give guidance to SMEs and accounting firms, as well as designing more service channels for FAQs, such as chatbots and virtual assistants. When the data are structured, the opportunities to design different service channels becomes easier.

The amount of audits performed by Tax Administrations might be reduced with a reduced workload for Nordic SMEs as a result.

Benefits for Statistical Authorities

This is a future benefit that has not yet been addressed in the pilot.

With future development of the ViDA Report process, Nordic statistical authorities could be given data from trade directly from the ViDA Report. This will possibly remove or reduce reporting burdens from SMEs in the future, hence this extension of data in accordance with the EU Commissions Once Only Principle.

This will significantly reduce the time for data access and quality and may contribute to improved analyses for macroeconomic predictions.

Related information

Project manager Jan Andre Mærøe

Do you have questions about eReceipt or need to get in touch with the project manager?