Invoice - user story

NorSupplier AS has received an order and sent an order response back to FinCustomer OY through the two access points using a standard format (Peppol BIS). The order from FinCustomer OY is based on the catalogue NorSupplier AS sent. NorSupplier AS has documented the delivery through the order response and confirmed the delivery to the transport company. NorSupplier AS has delivered the products or services to the location specified in the order, and FinCustomer OY has recorded the information in the solution to update the order.

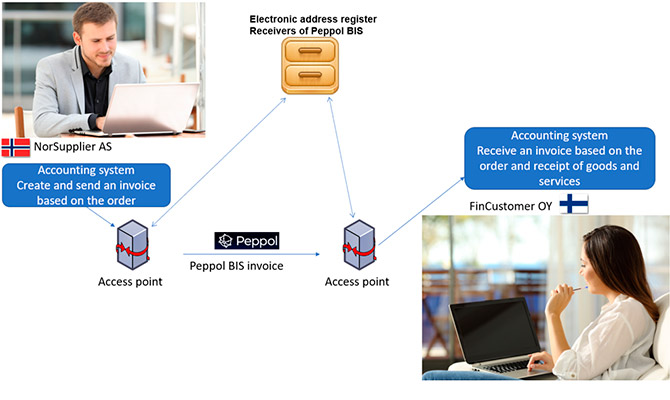

NorSupplier AS use all data from the process to create the Peppol BIS invoice (order, order response, delivery). Important invoice details include correct rates and codes, the price and price unit, the product number and standard item classification (UNSPSC).

It is also important to include the customer’s purchase order number (PO-number) so the customer solution can automatically match invoices and orders. If the customer has sent the contract number in the order, NorSupplier AS must also include this in the invoice so that FinCustomer can track all invoices in the contract.

Based on the information gathered in the process, the NorSupplier AS solution creates a Peppol BIS invoice and sends the invoice, and the FinCustomer OY solution receives the file. The accounting solution performs a lookup, based on the PO-number, and compares every line in the invoice with the lines in the updated order. If the order and the invoice match, the solution confirms the invoice automatically and sends it for payment. If the invoice and order do not match, it has to be investigated who the receiver is and if the invoice has to be manually processed.

NorSupplier AS must include all information in the correct format (xml), instead of as a PDF attachment, so FinCustomer OY are able to automate the processing.

Benefits for the buyer

- Based on machine readable data, the buyer can process the invoice automatically.

- Based on standard classification, an aggregated analysis for the company´s purchase is performed.

- Increase in the trackability and quality of the information.

- Based on the order-invoice match, it saves time for each transaction.

- More efficient audit.

- Reduced number of invoices paid with an incorrect amount and VAT rate.

- High control of invoices that are not in accordance with the order, with the possibility to route the invoice to the right buyer and return wrong invoices to the seller.

- Avoidance of late payments.

- Possibility to automate credit invoice handling, if needed.

- It is more efficient to receive invoices in a standard format from all sellers through a standard way of receiving.

- Easier to communicate with foreign sellers.

Benefits for the seller

- Automates the creation of invoices with information from the order and order response.

- More efficiently sends invoices in a standard format to all customers through a standard way of sending.

- Payments from the customers are received on time or faster.

- Increased control with invoices sent to all customers.

- Possibility to create a credit note based on invoice information.

- Increases customer satisfaction regarding the contract.

- Easier to communicate with foreign customers.

- Easier to carry out book keeping.

Benefits for the service provider (ERP)

- Increase in turnover.

- Transactions can be sent domestically and across borders in one format and via a channel (Peppol Network). This will reduce integration costs by replacing one-to-one integrations with one as opposed to many.

- By using a standard format for the exchange of invoices, costs are reduced when it comes to solution development.

- As the market (customers-buyers and suppliers) becomes more mature and arrangements have been made to connect buyers and suppliers, it is more easily done via one network, hence the service is easier to sell to the market.

- ERP has implemented services for invoices based on a standard format, thus it can be easier to develop new services to support the whole eProcurement process.

Nordic SME - what to do to get digital

To get digital means you improve all your processes and become competitive in your national, Nordic and European market using a single solution, not sticking to a manual and inefficient way of communicating with your customers and suppliers. Here are some suggestions for how to get digital:

- Ask your solution provider if they can send and receive transactions using a standard format (Peppol BIS), and send and receive transactions through the Peppol network, both nationally and across borders

- If you do not use a solution, you can find a list of solutions that can perform national and cross border transactions here

- As a supplier it is important for you to be able to present your product and services, not only in your own web shop, but also in your customer’s solution. Look at the solution’s capabilities and ask them to help you send and receive a Peppol BIS order and order response through the Peppol Network. Also asl if they can help you with creating and sending a Peppol BIS catalogue.

- If your solution wants to implement Peppol BIS, they can ask for information from your Peppol authority:

PEPOL authorities

Sweden: peppol@digg.se

Finland: rte@valtiokonttori.fi

Iceland: hjalp@fjs.is

Denmark: peppol@erst.dk

Norway: peppolmyndighet@dfo.no